As seen on AZBigMedia.com, 3/2/2022.

For many people, the thought of buying a home in Phoenix right now seems daunting and out of reach, but that doesn’t have to be the case. There’s a lot to consider when deciding whether to rent or buy a home, and you may not know where to begin. Never fear, you’ve got this! As home values around the country continue to rise, home ownership continues to present itself as a wealth building opportunity. Currently, from a financial standpoint, states in the southern U.S. present some of the opportunities to buy because they are less expensive than densely populated areas like California and New York. The desert southwest also continues to be a great place to consider homeownership. For those who plan to buy a house in Phoenix, it is important to understand market dynamics.

Pandemic Makes Home Ownership Lucrative

Since the beginning of the pandemic, the housing industry has been plagued with labor and supply chain issues, creating higher demand for low inventory, which in turn, also contributed to fewer new construction builds for single-family housing and rental properties. Americans quickly realized that owning a home, or property in general, was the best investment they could make as more people worked remotely and operated every facet of their lives from home.

More Affordable to Buy Than Rent

A new report shows about 65% of Arizona households, around 1,735,786 million homes, are owner occupied. Closer to home in the Phoenix metro, homeowners and renters are neck-and-neck with their monthly payments, where the median gross rent is $1,572 per month and the median monthly mortgage payment is $1,540 per month. In other parts of the state, homeowners on average pay $415 less per month than renters.

So, why is rent and mortgage in Phoenix nearly the same? Over the past few years, Phoenix’s rental market and real estate market have become extremely competitive due to the inflow of new out-of-state residents. The increased population coupled with the number of new home builds lagging behind population growth had led to an increase in property values.

A Cromford Report February outlook showed that the rental supply is starting to improve, which might help cool the market and level out rental rates, but it’s likely to happen over an extended period and not quickly enough.

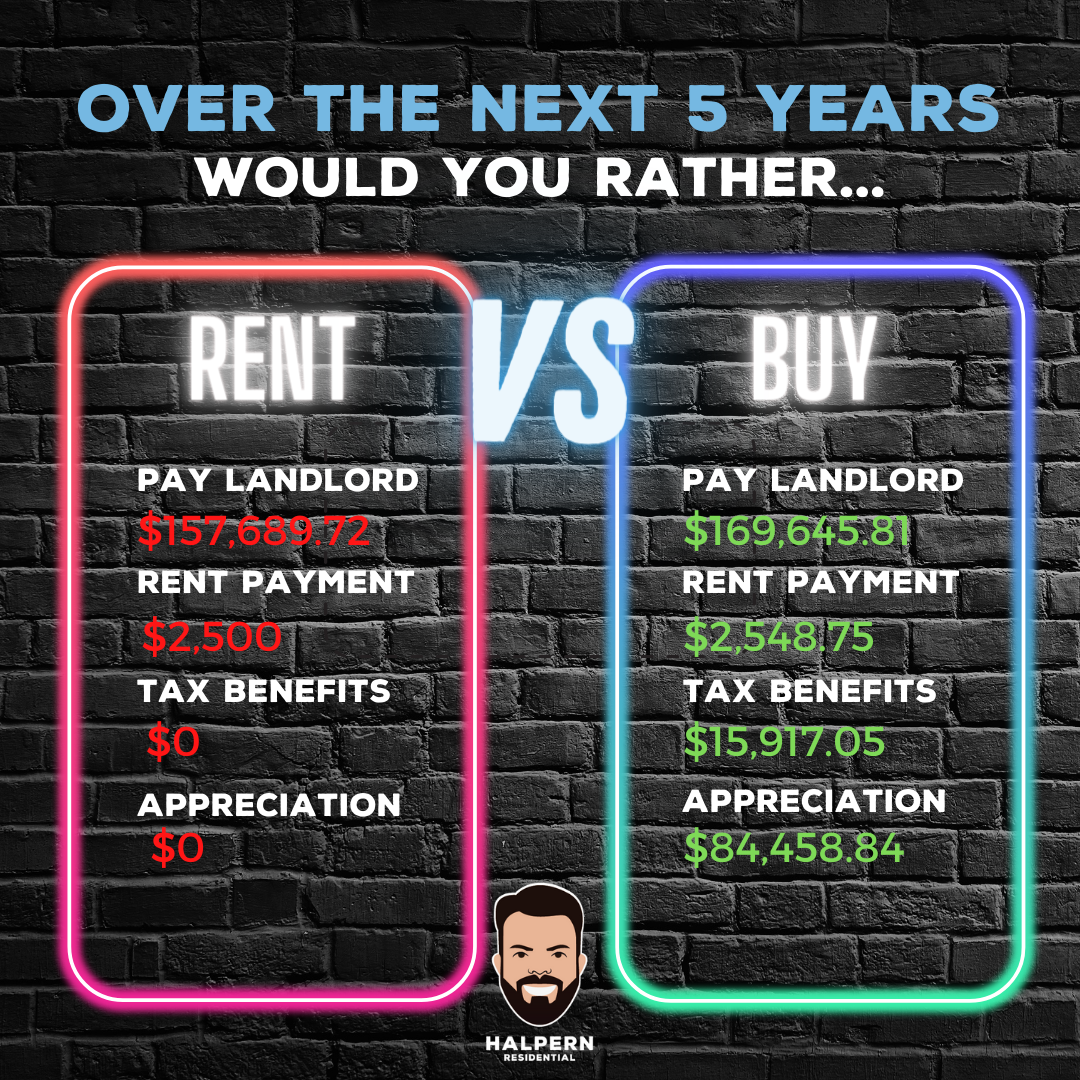

Benefits of buying a home in Phoenix vs. renting

Renting may be more convenient for some people, but it has its drawbacks as well. When renting, every time you pay rent, that money goes into someone else’s pocket. When you own, each payment helps pay down your mortgage debt, thus increasing your long term wealth. When renting, landlords dictate the condition of the home you are renting as well as the personal touches you can do at the home. They also control the duration of your lease (when signing) and what it looks like when your lease is up. With rents going up by over 20% per year in Phoenix, chances are your rent will go up at the end of your lease.

When it comes to home ownership, there are many short and long-term benefits that give you a chance to make a significant investment in your and your family’s future. If you have good credit, you can get a lower interest rate, which makes for more affordable monthly mortgage payments. Regardless of credit status, when you purchase a home, you lock your payment in for the duration of your mortgage. In an appreciating sale and rental market, this is amazingly powerful. Buy today and pay the same, instead of paying 20% more next year for the same home, whether a rental or a purchase. Repaying a mortgage faster also helps build equity in your home. Having a home equity line of credit, which can be used to pay for your child’s college tuition, vacations, or other large investments, is a major benefit of generating equity. In the long run, homeowners end up saving more money than renters if they take out a 30-year mortgage at a low interest rate, even when factoring expenses such as insurance, taxes and repairs.