The rock bottom interest rates that were a welcome reality over the last few years are now gone. As a result of inflation, everything costs more these days, including mortgage loans, which have risen dramatically. For the first time since the financial crisis in 2008, average mortgage rates are higher than 5%. The Fed is expected to continue raising rates as we approach the late spring and summer housing market, which in turn affects mortgage interest rates. As a home buyer, increased interest rates directly affect your bottom line, resulting in a higher monthly mortgage payment, among other expenses. Let’s explore what this means for you, if you’re in the market to buy a home.

Why Are Mortgage Rates Rising?

Inflation is out of control for major commodities such as housing, energy and food. We’re currently experiencing the highest inflation rates in more than 40 years. To make matters worse, workers’ earnings can’t keep up with inflation. During the week of April 11, the average rate on a 30-year fixed mortgage surged to 5.25 percent from 4.95 percent just a week prior – the highest level since 2009.

The Fed is expected to continue raising rates the rest of the year to continue battling inflation, recently announcing six additional rate hikes proposed in the near future.

While a quarter of a percentage point increase here or there doesn’t sound like a lot, it adds up significantly for expensive purchases like buying a home.

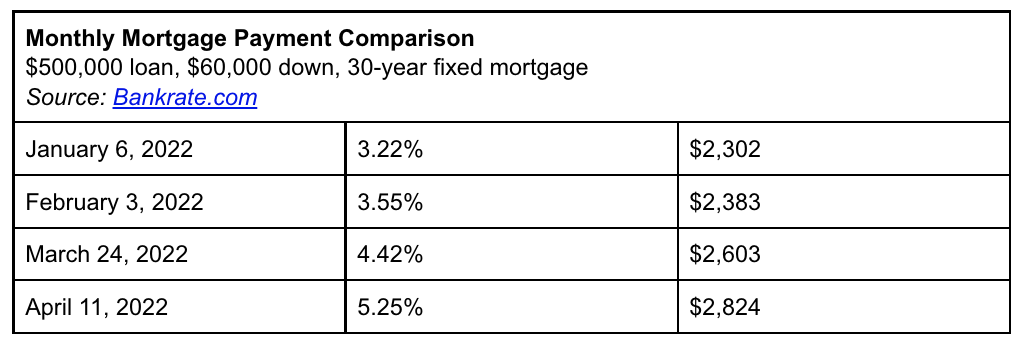

Let’s explore what this looks like. Though a 20% down payment was once standard, the median average is now 12%. So, let’s say you put $60,000 down for a $500,000 loan with a 30-year fixed mortgage, here’s what your monthly payments would translate to if you bought a home now versus just in the last few months prior:

As you can see, every little increase matters. If you buy a home now compared to when rates were still relatively low in January, you now pay $522 more a month, essentially $6,264 more annually, which adds up in the long run.

Homes Are Still Selling

Though there are talks that higher mortgage rates combined with rising home values may eventually cool the housing market, especially with lower inventory – that isn’t necessarily the case in Phoenix – where the market is still robust and competitive!

According to the analysts at the Cromford Report, supply has been increasing around the metro since January with 400 new single-family listings in Scottsdale, 180 in Buckeye and 160 in Chandler.

Cromford notes that the average home has increased in value by $164,757 (a 47% increase) since this time last year. With higher home prices and mortgage rates, some potential buyers that fall within affordable housing income brackets won’t qualify for their loans and it’s likely they can’t bid over asking, which is oftentimes needed in this market to make a competitive offer.

With that said, we’re still seeing multiple offers on homes in the metro, with sale prices going above list prices and properties selling within the first couple of weeks, if not days of listing.

What Can You Do?

Interest rates have already gone up 1.5% this year, which is significant and changes things for many households forced to take a hard look at their finances. The general rule of thumb is that for every 1% interest rates go up, you as a consumer lose 10% of your buying power, because so much more of your payment is going to cover costs associated with the higher interest rate.

If you already own a home and are wondering if you should refinance, the truth is that the window has closed for many. However, it’s worthwhile to refinance if you can get your interest rate reduced by at least 0.75 to 1 percentage point. This can reduce your monthly payments by at least $500 or more.

The best thing you can do right now as a buyer, is to have a trusted real estate agent and a financial lender work together to help you come up with the best strategy for a path forward. If you don’t know where to start with a lender, we’re happy to provide some recommendations.

One major step that can help is to check with a lender to see if you qualify for a mortgage rate lock. A lock essentially puts a hold on an interest rate between the time you make an offer and when you close. A lender can help you figure out if it is worth locking a rate in the future, not knowing where rates will be by the time you close.

Even though mortgage rates are high now, if you can financially swing committing to home ownership for at least the next five years, you can save money in the short term with tax write-offs. Furthermore, as interest rates rise, we are seeing those who were narrowly able to afford to purchase fall out of the market. If you are able to still afford to buy, it means less competition out there for you. Additionally, the fewer buyers there are, the more balanced we will see the market become. As buyers fall off and as more homes come on the market, we may see the needle shift from being a “seller’s market” to more balance, which improves your ability to negotiate and get a fair deal as a buyer. Less buyer demand will also eventually lead to a lowering of the trajectory of price increasing. At least for now, over the horizon, we are still expecting home values to increase in the great metropolitan Phoenix area, but less demand will take some wind out of the appreciation sails.

At Halpern Residential, it’s important for our team to stay in front of these unprecedented trends in the housing market. We understand our dynamic market like no other, and when it comes down to it, we roll up our sleeves and hustle with you. The truth is, real estate is not black and white – much of it is gray – so even if you feel buying a home is out of reach, our experience and thought leadership can help make home buying work in your favor.

Contact Halpern Residential today and take a giant leap forward in owning the home of your dreams in one of the most sought-after places in the country.