With inflation at a 40-year high, interest rates on the rise, and continued supply chain issues, the economy is struggling to gain resiliency in a post-pandemic world. With all of this pressure on the economy, fears that a recession is impending are becoming the talk of economists, talking heads and around the water cooler.

Here locally, it is nearly impossible to separate the recession discussion from that of real estate. If a recession becomes a reality, what does history tell us about what to expect when it comes to home values?

The good news is that not all recessions are the same and the housing market doesn’t always plummet. Instead, an economic downturn can provide lucrative opportunities in real estate investments. Below, we’ll explore what causes a recession, how it affects the housing market and how you can invest in real estate in a way that works for you regardless of broad economic conditions.

What is a Recession?

Let’s go with the textbook definition of a recession, which is a significant decline in economic activity that lasts months or years. Economic experts will declare a recession when the economy experiences a negative gross domestic product (GDP), steep unemployment, falling retail sales, and contracting measures of income and manufacturing for an extended period.

What Factors Lead to a Recession?

There are many indicators that cause the economy to shift downward. With today’s events, Americans are dealing with record inflation as prices for essentials such as groceries and gas are sharply rising. The feds have been raising interest rates to fight inflation, currently at 8.5% – the highest since the 1980s. Investors are closely watching a frantic stock market and consumer confidence has dropped to an 11-year low.

What Happens to Real Estate in a Recession?

Broadly speaking, new housing construction and home values can decline during recessions, but it also entirely depends on other economic variables unique to that period, combined with geo-targeted housing market trends.

The Great Recession (2007 – 2009) was the worst economic disaster in U.S. history since the Great Depression (1920s – 30s). Caused by the subprime mortgage crisis, three-million Americans filed for foreclosure in 2008, which was one in every 54 homes. The silver lining is that not all recessions are the same and economists don’t expect this one, if it happens, to be anywhere near as bad.

If history teaches us anything, it’s that investing in real estate is one of the best hedges against inflation and helps weather economic downturns like a recession. For example, to stimulate the economy, the feds will loosen monetary policy, resulting in lower mortgage rates, which boosts home sales. For example, in 2001, home prices during the Dot-com recession grew 6.6%, and during the 1980 recession, prices grew by 6.1%.

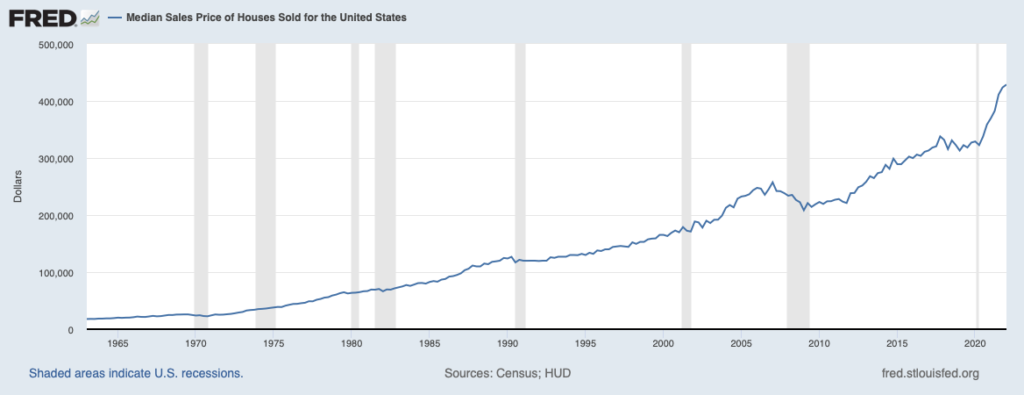

With the exception of the Great Recession, home values have weathered the storm, either holding steady or increasing in value, as shown in the chart below. If you click on the link below the chart, you can toggle over the interactive graph to track home values through the last eight recessions.

Shaded areas indicate U.S. recessions. Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development, Median Sales Price of Houses Sold for the United States [MSPUS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MSPUS, May 26, 2022.

Housing Market Still Strong in Arizona

Economic slump or not, Arizona is still one of the most dynamic real-estate markets in the country – and a strong housing market can contribute to helping the country get out of the red.

Our friends at the Cromford Report, who painstakingly forecast and analyze the local market, note that the downward trend in supply has reversed course with home listings increasing over 30% in the past six weeks – one of the most dramatic shifts they’ve seen. Cromford adds that supply is growing in almost all areas of Maricopa County, but demand is down 6% since last month. That means it’s an opportune time to take advantage as an investor and shop the market for income-producing real estate.

Rental properties can help soften the blow in economic recessions because of the passive income they provide (especially as rents continue to rise) and because of long term appreciation. Cromford notes that between April 2021 – 2022, there was an 8.5% increase in investors purchasing properties to turn into rentals. In fact, demand from investors for rentals now represents over 20% of all local home sales. With Maricopa County’s increase in active listings, there’s more opportunity to make investment real estate a reality to build a secure nest egg, no matter which way the economy shifts.

Start Your Real Estate Investment Journey with Halpern Residential

Through past recessions, many real estate investors built and scaled their property portfolio even during the darkest stages of economic downfalls. Many who invested wisely not only emerged unhurt, but they also saw themselves in a stronger financial position than ever before. If you’re unsure where to start, that’s where our knowledgeable team at Halpern Residential comes in.

We’re immersed in one of the most-watched real estate markets in the country. Take advantage of our real-world tips to navigate buying and selling in Phoenix and use them to your benefit. Learn how our strategy and insight can help you make money through all the ups and downs of the market. Recession ahead or not, we’re one phone call away when you need us.