The Phoenix real estate market is hot for sellers, so if you plan on listing your home soon, and if you position it correctly on the market, prepare for the floodgate of offers to open. There are fewer properties up for grabs, and many buyers will flash their cash as a competitive edge to stand out. Recent data shows all-cash home sales make up nearly 40% of the national market.

A cash buyer is exactly what it sounds like; a person or company who has the funds to pay for your home with no mortgage loan or other financing. You’re probably wondering, should I take cash for my home? That’s an excellent question. We’ll walk you through what to expect when you receive an offer from a cash buyer.

The Rise of iBuyers

Cash buyers have been around forever. Two of the most common are investors who purchase your home to rent it out for passive income, and house flippers who renovate your home to sell it for a profit.

A new breed emerging in popularity is the iBuyer. An iBuyer is an internet buyer who uses automated valuation model (AVM) technology to value your home and sends an instant offer. An iBuyer will use sites like Opendoor, Offerpad, Redfin Now or Zillow Offers, and purchase a home sight unseen.

If you receive a cash offer for your home, it’s highly likely it’s coming from one of these kinds of cash buyers or a combination thereof.

Cash Buyers Pros and Cons

Cash offers have many advantages most times. A new Zillow survey shows nearly 80% of realtors report submitting cash offers on behalf of their clients. In fact, 40% of listing agents said a cash offer was the most effective strategy in their recent transactions. However, cash offers aren’t right for every seller. Let’s explore the pros and cons of accepting a cash offer:

Pros

- Low Risk. Cash buyers present a much lower risk to a seller. A buyer who needs financing can take weeks to get the purchase approved. That’s valuable time the home is off the market, and there’s a chance the bank won’t approve the loan.

- Quick Closing. Cash offers streamline a speedy transaction, which is attractive if you want to sell your home quickly.

- Convenience. Most cash buyers waive appraisals and inspections since there’s no mortgage lender involved. Many will buy your home “as is”, which could save you from costly repairs.

Cons

- Lower Offer. Many cash offers come in lower than traditional ones. Typically, if an investor is buying a home to flip it, they’re concerned about making a profit, and will probably factor in how much they’ll spend on repairs into the amount they offer. However, you can expect some cash buyers to purchase a home above the asking price in a very competitive market, such as this one.

- Verify Funds. A cash offer doesn’t mean the buyer will show up at your front door with a briefcase full of crisp cash. Verify how they’ll front the transaction, whether it’s something like liquid cash or selling stocks. You should also ask the buyer to provide proof of their funds such as a bank statement or letter of credit from their financial institution.

- Losing Bids. Low housing inventory means there’s more competition. Bidding wars can help you get the most money for your home. Accepting a cash offer prior to listing the home on the open market can take out the possibility of getting the highest possible bid.

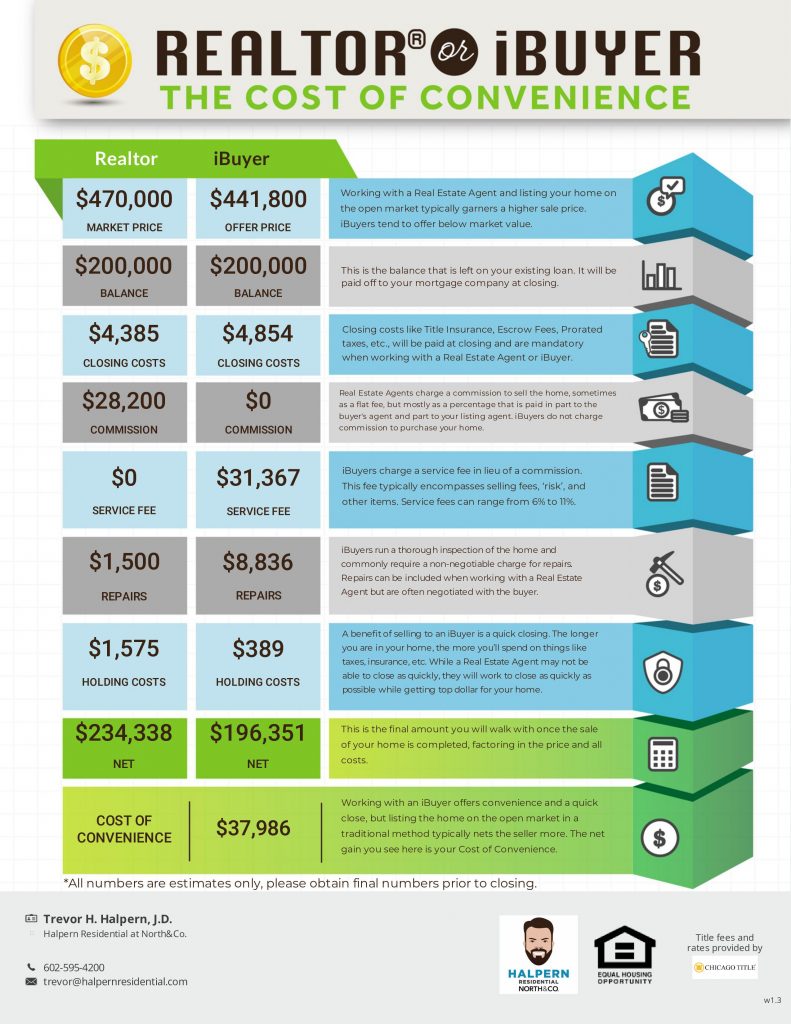

Understanding iBuyer Costs

Though most cash buyers will eat repair costs, iBuyers won’t. They’ll often charge you for repairs and tack on additional costs, including hidden fees you didn’t know about. Here’s a helpful infographic to understand what to expect from an iBuyer transaction on a home listed for $470,000:

Work With An Agent

There’s no one size fits all approach when considering a traditional sale or taking cash for your home. At Halpern Residential, we’ve recommended a client take a cash offer because it couldn’t be beat. We’ve equally recommended winning offers that rely on a mortgage because the overall set of circumstances better aligned with the Seller’s goals. It’s a complicated process and our expert team will help you weigh your options and recommend the best approach.

If you have questions about cash buyers that aren’t answered here, call Halpern Residential at 602-595-4200 or shoot us a note. You can also watch Trevor’s monthly Fireside Chat on his YouTube channel, or drop him a line on Facebook or Instagram.